The interest earned on the Term Deposit is Rs80000. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

In The Matter Of Interest Crowe Malaysia Plt

In year 2008 the company receives interest amounting to RM10000 from the fixed deposit.

. Interest earned on a fixed deposit for. Since a fixed deposit interest is deemed a tax exemption and you dont have any tax relief at the moment we will talk more about tax relief and tax exemption later the calculation would look like this. 1 company trip outside Malaysia for up to RM3000.

As a concession companies except dormant companies are allowed to carry forward unabsorbed tax losses even when there is a substantial change more than 50 in the shareholders. S33 1 a specific deductibility of interest expense. Does the participant have to submit any personal tax declaration to the Income Tax Department of Malaysia like Malaysians have to.

A fixed deposit is an investment in which a specific sum of money is invested for a set period of time. Fixed Deposits can be held for any period of time. The unabsorbed tax losses of the target company brought forward from previous years will be available to offset against future business income of the target company.

The company has not generated any income from the plantation activity. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return. The full amount of gratuity received by an employee on retirement from employment is exempt if.

3 company trips within Malaysia. This means that if you want to deposit RM10000 into the FD youve also got to deposit RM5000 into a CASA bringing the total amount deposited to RM15000. Regular Fixed Deposits provide a loan facility.

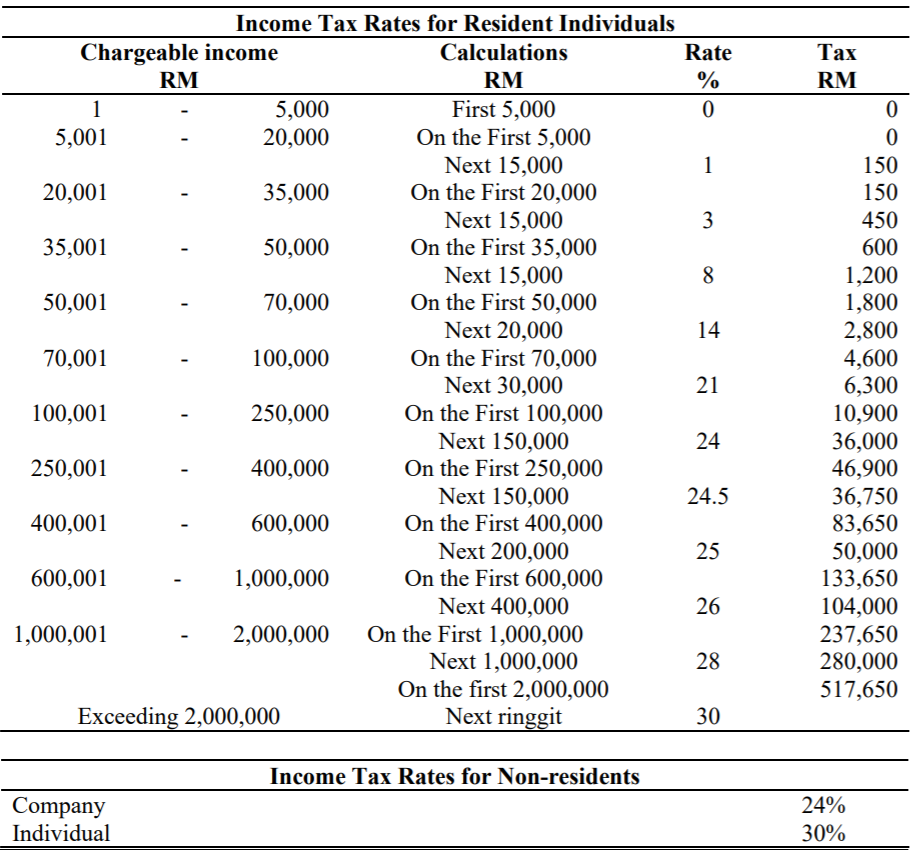

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. The provisions relating to the tax treatment of interest expense are. S33 1 general deductibility of expenses.

Leave passages within Malaysia not exceeding three times on a year and one leave passage outside Malaysia not exceeding RM3000. Hence the balance amount of tax to be paid by. S33 4 and 5 interest deductible when due to be paid and relevant compliance requirement.

Lets say Ahmad has a gross annual income of RM50000 which consists of RM48000 in salary and RM2000 in parking allowance. Manish will also have to pay interest earned on the tax rate equal to the gross income. A TDS of 10 is deducted by the bank on the income earned from interest which is Rs8000.

Valuations of some types of employment income are as follows. There are no premature withdrawals loans or overdraft OD facilities for tax-saving FDs. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

As part of a Tax Saving Fixed Deposit interest earned is taxable which is deducted at source. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. And fixed deposit in several banks.

These are payments made to an individual or company for the ongoing use of. An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits. If you deposit 100000 in your savings account for 12 months the bank will in return pay a rental fee interest rate usually between 05-2 to you for borrowing your money.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in. Even though the income of Sawit Sdn Bhd is 100 derived from the saving in. Any benefits used only for the performance of your job duties.

Malaysia is under the single-tier tax system. Even though the income of Sawit Sdn Bhd is 100 derived from the saving in. For their 6-month FD but you have to deposit 50 of your FD amount into a CASA as well.

Tax Exemptions For Individuals. In year 2014 the company receives interest amounting to RM10000 from the fixed deposit. The company closes its account on 31 December every year.

The company has not generated any income from the plantation activity. Among the examples of interest income mentioned in PR 32016 that cannot be treated as business income from YA 2013 are interest charged due to delay in payment of trade debt interest from an easy payment plan interest from fixed deposit placed as security and interest received by a person from loan given to employees. Effective date 21 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board Malaysia.

Gross income tax exemptions. Take the total amount of income you are earning and minus off the types of income that isnt taxable. Anything not covered by the above list or exceeds the limits of the list will be considered part of your income and will be taxable as normal.

Because parking allowance is tax exempted his taxable income is only RM48000. RM54400 RM1500 RM52900 Total Taxable Income Tax Exemption Chargeable Income. A Fixed Deposit Account Bank receives a certain sum of money which is deposited for a certain period either on short term or long term.

From 7 to 10 years is possible. Treatment of interest expense attributable to dividend income received by a company 19 - 21 12. For example Bank B advertises an interest rate of 428 pa.

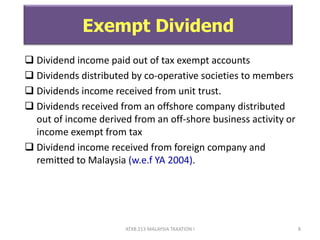

Medical and dental benefit. Dividends are exempt in the hands of shareholders. Sources of Interest Income 41 Financial Deposit Product Commercial banks and financial institutions pay interest to depositors through various financial deposit products which among others are as follows.

Is Interest Income From Fixed Deposit Taxable In Malaysia. There is no tax on income that isnt taxable. Youll then have earned between RM 500 RM 2000 in 12 months.

Accommodation provided by your employer. And fixed deposit in several banks. 14 Income remitted from outside Malaysia.

Interest on fixed deposit account of up to a maximum of RM10000000. Therefore he will have to pay 20 of Rs80000 which is Rs16000. The company closes its account on 31 December every year.

Corporate shareholders receiving exempt single-tier dividends can.

Managing Corporate Taxation In Latin American Countries Peru Corporate Tax Peru

Taxable Income Formula Calculator Examples With Excel Template

The Model Estimation Result Of The Corporate Tax Planning And Download Scientific Diagram

Corporate Income Tax In Malaysia Acclime Malaysia

When Are Taxes Due In 2022 Forbes Advisor

Personal Income Tax Interest Income Tax Treatment

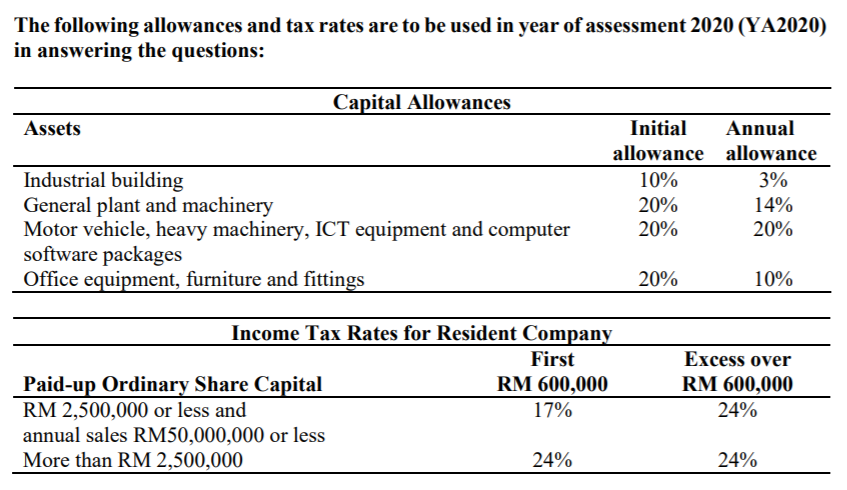

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Chapter 5 Non Business Income Students

Tax And Investments In Malaysia Crowe Malaysia Plt

Taxable Income Formula Calculator Examples With Excel Template

Taxation Principles Dividend Interest Rental Royalty And Other So

Individual Income Tax In Malaysia For Expatriates

Taxation Principles Dividend Interest Rental Royalty And Other So

Quick Overview Of Czech Real Estate Rsm Cz

The Following Allowances And Tax Rates Are To Be Used Chegg Com

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)